Introduction

You’ve found the perfect pneumatic cylinder supplier overseas with prices 40% below domestic options. You place your first order, excited about the savings—until customs holds your shipment for weeks, unexpected duty charges eat half your margin, and you’re scrambling to understand HS codes1, tariffs, and import regulations you never knew existed. What seemed like a great deal has turned into a logistical nightmare that’s costing you time, money, and credibility with your customers. 😰

Importing pneumatic components requires understanding HS classification codes (typically 8412.31 for pneumatic cylinders), calculating landed costs2 including duties (0-5% for most pneumatic parts under current US tariffs), taxes, and freight, selecting appropriate Incoterms3 (FOB, CIF, or DDP), working with customs brokers or freight forwarders, and ensuring compliance with country-specific regulations to avoid delays and unexpected costs.

I’ll never forget the call from Tom, a machine builder in Illinois who’d ordered 50 rodless cylinders from us. His shipment sat at customs for three weeks because his broker used the wrong HS code, triggering additional scrutiny. After I walked him through proper documentation and classification, his next shipment cleared in 48 hours. That’s the difference proper import knowledge makes. 📦

Table of Contents

- What Are HS Codes and How Do You Classify Pneumatic Components?

- How Do You Calculate Total Landed Costs for Imported Pneumatics?

- Which Incoterms Should You Use When Importing Pneumatic Parts?

- What Documentation and Compliance Requirements Must You Meet?

What Are HS Codes and How Do You Classify Pneumatic Components?

Getting classification right is your foundation for smooth imports and accurate cost calculations. 🎯

Pneumatic cylinders are typically classified under HS code 8412.31 (linear acting cylinders), pneumatic valves under 8481.80, and fittings under 7307 or 8481 depending on material and function—proper classification determines duty rates, ensures customs clearance, and affects total landed costs, making it essential to verify codes with your customs broker or supplier before shipping.

Understanding the HS Code System

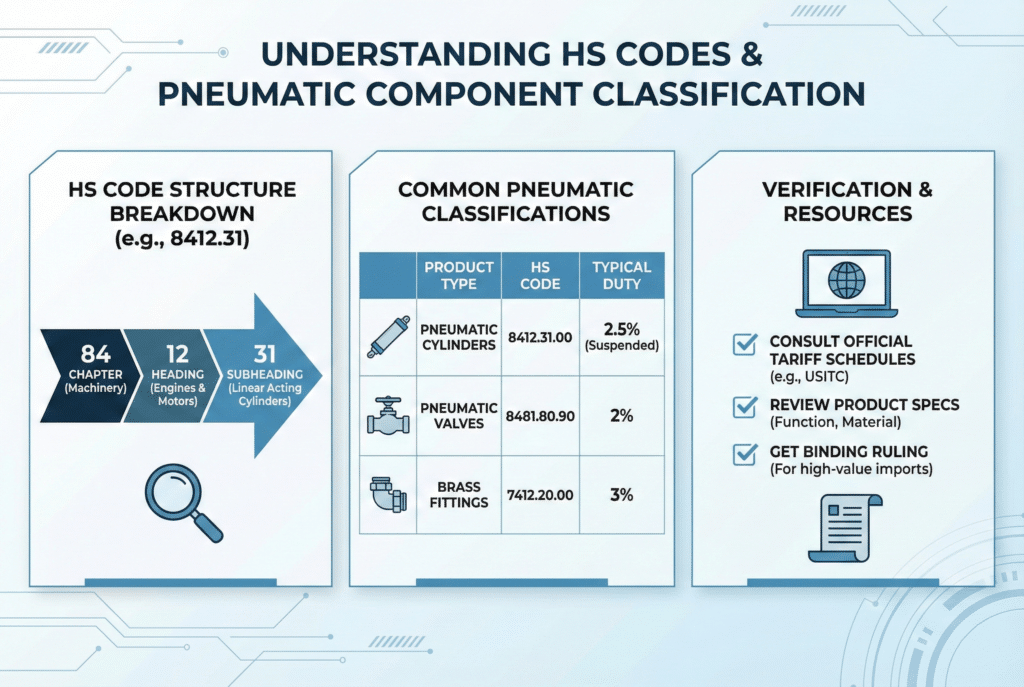

The Harmonized System (HS) is the global standard for classifying traded products:

Structure breakdown:

- First 2 digits: Chapter (e.g., 84 = machinery)

- Next 2 digits: Heading (e.g., 8412 = engines and motors)

- Next 2 digits: Subheading (e.g., 8412.31 = linear acting cylinders)

- Additional digits: Country-specific classifications (e.g., US uses 10-digit HTS codes)

Common Pneumatic Component Classifications

| Product Type | HS Code | Description | Typical US Duty Rate |

|---|---|---|---|

| Rodless cylinders | 8412.31.00 | Linear acting pneumatic cylinders | 2.5% (currently suspended) |

| Standard cylinders | 8412.31.00 | Linear acting pneumatic cylinders | 2.5% (currently suspended) |

| Pneumatic valves | 8481.80.90 | Other taps, cocks, valves | 2% |

| Brass fittings | 7412.20.00 | Copper alloy tube/pipe fittings | 3% |

| Stainless fittings | 7307.19.90 | Other stainless steel fittings | 0% |

Important note: Duty rates change based on trade agreements, country of origin, and political factors. Always verify current rates before importing. 🔍

How to Verify Your Classification

I worked with Sarah, a packaging equipment distributor in Texas, who was incorrectly classifying her pneumatic cylinders under a generic “machinery parts” code, paying 5% duty instead of the correct 2.5%. Here’s how we fixed it:

Step 1: Consult the official tariff schedule

- US: USITC Harmonized Tariff Schedule4 (hts.usitc.gov)

- EU: TARIC database

- Other countries: Local customs authority websites

Step 2: Review product specifications

- What is it? (Pneumatic linear actuator)

- What does it do? (Converts compressed air to linear motion)

- What’s it made of? (Aluminum, steel, seals)

- How does it work? (Linear acting cylinder)

Step 3: Get a binding ruling (for high-value imports)

- Submit detailed product information to customs

- Receive official classification decision

- Valid for future shipments

- Protects against reclassification penalties

At Bepto Pneumatics, we provide proper HS codes on all commercial invoices and can supply technical documentation to support classification if customs requests it. 📋

How Do You Calculate Total Landed Costs for Imported Pneumatics?

The purchase price is just the beginning—understanding total landed cost prevents budget surprises. 💰

Total landed cost includes product price (FOB), international freight (10-20% of product value for air, 5-10% for ocean), customs duties (0-5% for most pneumatics), import taxes and fees, customs broker charges ($75-200 per shipment), and inland transportation—typically adding 25-40% to the FOB price depending on shipping method, volume, and destination.

The Landed Cost Formula

Total Landed Cost = Product Cost + Freight + Insurance + Duties + Taxes + Broker Fees + Inland Transport

Let me break down a real example from a customer in California:

Scenario: Importing 100 rodless cylinders from Bepto Pneumatics

| Cost Component | Calculation | Amount |

|---|---|---|

| Product (FOB Shanghai) | 100 units × $350 | $35,000 |

| Ocean freight | 1 CBM × $800 | $800 |

| Marine insurance | 0.5% of CIF value | $179 |

| CIF Value | $35,979 | |

| Customs duty | 2.5% of CIF (suspended) | $0 |

| MPF (Merchandise Processing Fee) | 0.3464% (min $27.75, max $538.40) | $124.65 |

| Harbor Maintenance Fee | 0.125% of cargo value | $44.97 |

| Customs broker | Flat fee | $150 |

| Inland trucking (port to warehouse) | Estimate | $400 |

| Total Landed Cost | $36,698.62 | |

| Cost per unit | $36,698.62 ÷ 100 | $367 |

Key insight: The $350 FOB unit price becomes $367 landed—still 35% cheaper than the $565 OEM domestic price, but you need to account for that $17 difference in your pricing. 📊

Hidden Costs to Watch For

Demurrage and detention charges:

If you don’t pick up your container promptly, ports charge $75-150 per day. I’ve seen customers lose thousands because they didn’t arrange pickup quickly enough.

Exam fees:

If customs selects your shipment for physical inspection, you pay $200-500 for the exam even if everything is correct.

Storage fees:

Customs warehouses charge daily storage if clearance is delayed.

Currency fluctuations:

If paying in foreign currency, exchange rate changes can impact your costs by 2-5%.

Which Incoterms Should You Use When Importing Pneumatic Parts?

Incoterms define who pays what and when risk transfers—choosing wrong costs money. 🚢

For pneumatic imports, FOB (Free On Board) gives you freight control and better rates for regular shipments, CIF (Cost Insurance Freight) simplifies budgeting for occasional orders, and DDP (Delivered Duty Paid) eliminates import complexity but costs 15-25% more—FOB is typically optimal for established importers, while DDP suits first-time buyers or those wanting turnkey delivery.

Incoterms Comparison for Pneumatic Imports

FOB (Free On Board):

- Seller responsibility: Deliver goods to port, load on vessel

- Buyer responsibility: Ocean freight, insurance, import clearance, inland delivery

- Best for: Regular importers with freight forwarder relationships

- Cost advantage: You control freight rates and routing

- Risk: You handle all import logistics

CIF (Cost Insurance Freight):

- Seller responsibility: Product, ocean freight, marine insurance to destination port

- Buyer responsibility: Import clearance, duties, inland delivery

- Best for: Moderate-volume importers wanting simplified ocean logistics

- Cost advantage: Supplier may have better freight rates

- Risk: Less control over shipping timeline

DDP (Delivered Duty Paid):

- Seller responsibility: Everything including delivery to your door

- Buyer responsibility: Just receive the goods

- Best for: First-time importers, small orders, or when simplicity matters most

- Cost advantage: Zero import complexity

- Risk: Highest cost, least transparency

I worked with Michael, who runs an automation equipment company in North Carolina. He started with DDP because he was nervous about importing. After three shipments, I helped him transition to FOB—he now saves $4,000 annually on the same volume by working with his own freight forwarder. 💪

Choosing the Right Incoterm for Your Situation

Choose FOB if:

- You import regularly (monthly or more)

- You have a freight forwarder relationship

- You want maximum cost control

- You’re comfortable managing logistics

Choose CIF if:

- You import occasionally (quarterly)

- You want ocean freight handled but can manage customs

- You’re building import experience

- Supplier has competitive freight rates

Choose DDP if:

- This is your first import

- Order value is under $5,000

- You need predictable, all-inclusive pricing

- You don’t have time to manage logistics

At Bepto Pneumatics, we offer all three options. Most of our experienced customers use FOB, but we’re happy to provide DDP quotes for first-time importers who want simplicity. 📦

What Documentation and Compliance Requirements Must You Meet?

Proper documentation is the difference between smooth clearance and costly delays. 📄

Essential import documents include commercial invoice (with accurate HS codes, values, and descriptions), packing list (detailed contents and weights), bill of lading or air waybill (proof of shipment), certificate of origin (for preferential duty rates), and any product-specific certifications—incomplete or inaccurate documentation causes 80% of customs delays, making attention to detail critical for efficient imports.

The Essential Document Checklist

Commercial Invoice (most critical document):

- Seller and buyer complete contact information

- Invoice number and date

- Detailed product descriptions (not just “pneumatic parts”)

- Correct HS codes for each item

- Quantity, unit price, and total value

- Incoterm used (FOB, CIF, etc.)

- Country of origin

- Payment terms

Packing List:

- Matches commercial invoice exactly

- Box-by-box contents breakdown

- Gross and net weights

- Dimensions of each package

- Total shipment volume (CBM)

Bill of Lading (ocean) or Air Waybill:

- Proof of shipment and title document

- Shipper, consignee, and notify party

- Port of loading and discharge

- Container number (for ocean freight)

- Freight charges and payment terms

Country-Specific Compliance

United States:

- ISF (Importer Security Filing)5 required 24 hours before ocean vessel departure

- FDA registration if components contact food/pharma products

- TSCA (Toxic Substances Control Act) compliance for certain materials

European Union:

- CE marking for machinery components

- RoHS compliance (restriction of hazardous substances)

- REACH registration for certain chemicals/materials

- EUR.1 or Certificate of Origin for preferential tariffs

Canada:

- CFIA requirements for food-contact components

- CSA certification for certain applications

- NAFTA/USMCA certificate of origin for duty-free treatment

I remember helping Jennifer, a food processing equipment builder in Ontario, who didn’t realize her pneumatic cylinders needed FDA registration because they were used in food production lines. We provided the necessary documentation and registration support, preventing a costly shipment rejection. 🛡️

Working with Customs Brokers

What customs brokers do:

- Prepare and submit import documentation

- Calculate duties and taxes

- Communicate with customs on your behalf

- Arrange payment of duties

- Coordinate cargo release

How to choose a broker:

- Experience with pneumatic/machinery imports

- Located near your port of entry

- Transparent fee structure ($75-200 per shipment typical)

- Technology integration (online tracking, document upload)

- Responsive communication

Pro tip: Many freight forwarders offer customs brokerage services—using one provider for both simplifies logistics and often reduces costs.

Common Documentation Mistakes to Avoid

🚫 Vague product descriptions: “Machine parts” triggers scrutiny. Use “Pneumatic rodless cylinder, aluminum body, 40mm bore, 500mm stroke.”

🚫 Incorrect values: Undervaluing to reduce duties is illegal and risks penalties. Always declare true transaction value.

🚫 Missing HS codes: Customs will classify for you, often incorrectly and at higher duty rates.

🚫 Inconsistent documents: If your invoice says 100 pieces but packing list says 110, expect delays.

🚫 Wrong country of origin: This affects duty rates and trade agreement eligibility.

At Bepto Pneumatics, we prepare professional, accurate documentation for every shipment. Our commercial invoices include detailed descriptions, correct HS codes, and all information customs needs for smooth clearance. We’ve refined this process over thousands of international shipments. ✅

Conclusion

Successful pneumatic component importing isn’t about avoiding duties and logistics—it’s about understanding them, planning accurately, and working with suppliers and service providers who make the process transparent, efficient, and cost-effective for long-term success. 🎯

FAQs About Importing Pneumatic Components

What’s the typical duty rate for importing pneumatic cylinders into the US?

Pneumatic cylinders (HS 8412.31) typically face 2.5% duty, though this is currently suspended under Section 301 tariff exclusions for many Chinese-origin products, resulting in 0% duty—however, rates change based on trade policy, so always verify current rates before importing. At Bepto Pneumatics, we stay updated on tariff changes and proactively inform customers of any rate adjustments that might affect their costs. We also provide proper HS classification on all documentation to ensure you pay the correct (often lower) duty rate.

Should I use a freight forwarder or handle shipping myself?

Use a freight forwarder for international pneumatic imports—they consolidate shipments for better rates (20-40% savings vs. individual shipping), handle documentation, arrange customs clearance, and provide door-to-door service, with costs typically 10-15% of shipment value being far less than the time and mistakes of self-management. I’ve never seen a customer successfully handle their own international freight without prior experience. The learning curve is expensive. A good forwarder pays for themselves through better rates and avoiding costly mistakes.

How long does customs clearance typically take?

Routine customs clearance for pneumatic components with proper documentation takes 1-3 business days in the US, 2-5 days in the EU, though physical inspections or documentation issues can extend this to 1-2 weeks—accurate paperwork and working with experienced brokers minimizes delays. At Bepto Pneumatics, we provide complete, accurate documentation that helps our customers achieve consistently fast clearance. Our US customers typically see 24-48 hour clearance times because we know exactly what customs needs.

Can I avoid duties by declaring lower values?

Absolutely not—undervaluing goods is customs fraud, punishable by fines up to $10,000, seizure of goods, and criminal prosecution in severe cases, and customs regularly compares declared values to market prices and previous shipments to detect undervaluation. Always declare true transaction value. The small duty savings isn’t worth the massive legal and financial risks. Legitimate cost reduction comes from proper HS classification, trade agreements, and efficient logistics—not fraud.

How does Bepto Pneumatics simplify the import process for customers?

We provide complete, accurate documentation with proper HS codes, offer FOB, CIF, or DDP terms to match your experience level, can recommend reliable freight forwarders and customs brokers, supply technical specifications for customs if needed, and maintain transparent communication throughout shipping and clearance. We’ve shipped to over 40 countries and understand each market’s requirements. Whether this is your first import or your hundredth, we make the process as smooth as possible. Let’s discuss your specific import needs and how we can support your success. 📞

-

Learn about the global Harmonized System used to classify traded products and determine duty rates. ↩

-

Understand the components of total landed cost to accurately budget for international procurement. ↩

-

Review the official International Chamber of Commerce rules for the use of domestic and international trade terms. ↩

-

Access the official USITC database to verify current HTS codes and duty rates for the United States. ↩

-

Read the official U.S. Customs and Border Protection requirements for Importer Security Filing to avoid penalties. ↩